Choosing the right investments based on your personal goals is an essential step in securing your financial future. With the vast array of investment options available today, it can be challenging to know where to start. However, by focusing on your priorities and understanding your financial objectives, you can make informed decisions that align with your vision. This guide will provide insights and strategies to help you choose investments wisely, ensuring that your financial aspirations are met effectively.

Understanding your unique investment goals is key to developing a robust portfolio. Are you saving for retirement, looking to generate passive income, or planning for a big purchase? Each of these objectives requires different investment strategies. By aligning your approach with your goals, you can mitigate risks and maximize returns. A well-thought-out investment plan tailored to your needs will provide a clearer path to achieving your financial dreams.

Understanding different types of investments

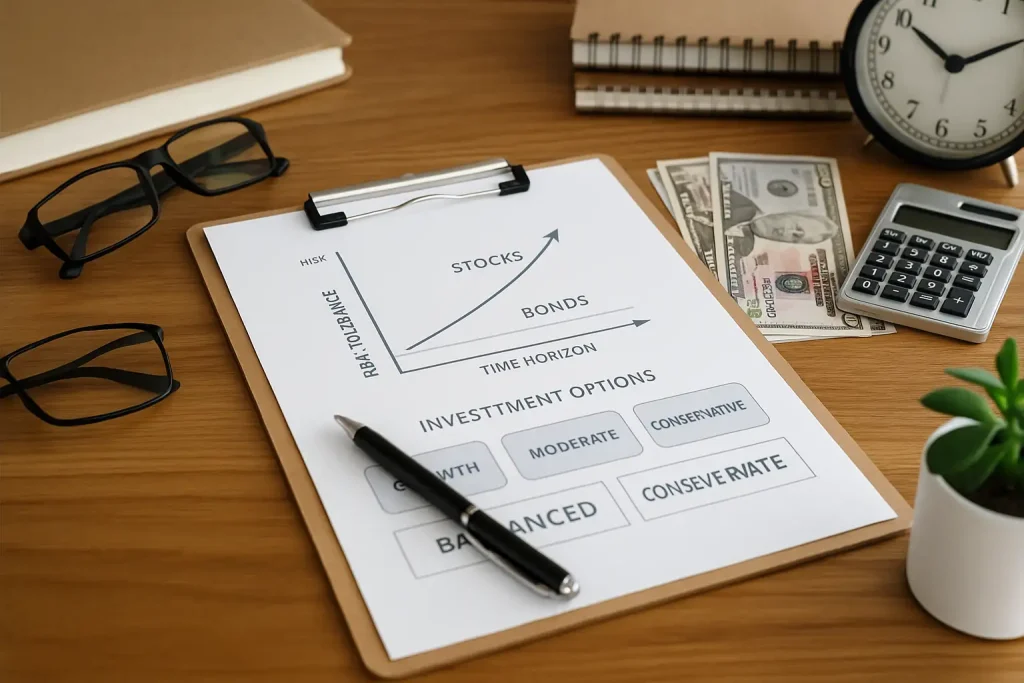

There is a wide variety of investment options available, each with its own set of benefits and risks. Stocks, bonds, mutual funds, ETFs, and real estate are some of the most common. The choice between these depends largely on your risk tolerance and investment horizon. For example, stocks are generally more volatile but offer potentially higher returns, while bonds are typically more stable. Understanding these differences is crucial for aligning investments with your goals.

Apart from knowing the types, understanding the taxation and liquidity of these investments is vital. Stocks and mutual funds might provide higher returns, but also come with capital gains taxes. Real estate can be less liquid than other assets, making it harder to convert into cash quickly. Knowing these aspects helps in balancing your portfolio according to both your financial situation and your investment goals, ensuring a comprehensive approach.

Aligning investments with your timeline

An essential part of investment planning is aligning your options with the timeline for your goals. Short-term goals, like a vacation or a small purchase, may benefit from low-risk, high-liquidity assets like savings accounts or certificates of deposit. Meanwhile, long-term goals, such as retirement, can allow for higher-risk investments, like stocks or real estate, which have more time to recover from market fluctuations.

Moreover, your risk tolerance should adjust as you approach your goal. A common strategy is to start with riskier investments when you have more time on your side, gradually shifting towards safer options as your target date nears. This approach helps protect your savings from potential market downturns, shielding you from significant losses as you approach your goal’s realization.

Creating a diversified investment strategy

A crucial element of effective investing is diversification. By spreading your capital across various investments, you reduce your overall risk and enhance potential returns. A diversified portfolio can include a mix of stocks, bonds, and other assets, tailored to your risk tolerance and goals. This strategy helps cushion against individual market declines, as losses in one area may be offset by gains in another.

Additionally, regular portfolio reviews are key to maintaining alignment with your financial objectives. As personal circumstances and market conditions evolve, adjustments might be necessary. Staying informed and being ready to adapt ensures that your investments continue to serve your long-term plans effectively, keeping you on track towards fulfilling your aspirations.

Ultimately, selecting investments based on your goals involves a blend of understanding, planning, and continuous evaluation. By narrowing down your options through careful assessment of risk, timeline, and personal circumstances, you can craft a portfolio designed to meet your needs. Prioritizing diversification further enhances your ability to navigate market volatility, offering peace of mind as you work towards your financial goals.